Exploring Lending Protocols Backed by Casinos: A New Financial Frontier

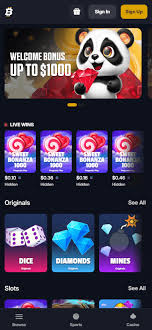

The financial landscape is evolving, with innovative technologies merging various sectors. One fascinating intersection is the combination of lending protocols and casino operations. These lending protocols backed by casinos are changing the way individuals can access liquidity and engage with their financial assets. By leveraging the revenue potential of casinos, these protocols offer unique benefits to borrowers and lenders alike. Platforms such as Lending Protocols Backed by Casino Cashflows Bitfortune .com are among those exploring this novel avenue, paving the way for greater opportunities in decentralized finance (DeFi).

What Are Lending Protocols?

Lending protocols are decentralized platforms that allow users to lend and borrow cryptocurrencies and other digital assets. They operate on blockchain technology, enabling secure and transparent transactions without the need for a central authority. Users can earn interest on assets they lend while borrowers can access the capital they need by putting up collateral.

The Marriage of Casinos and Lending Protocols

Casinos have long been associated with risk and financial transactions. The profits generated from gaming activities are substantial, leading some visionary entrepreneurs to explore how this revenue can back lending platforms. By doing so, they create a system where users can benefit from both the thrills of gambling and the financial advantages of borrowing at competitive rates.

How Casino-Backed Lending Works

Casino-backed lending protocols typically operate by using the revenue generated by casinos as collateral for loans. This innovative approach reduces the risk for lenders and allows for more favorable borrowing terms for users. For instance, if a casino generates consistent income from its operations, that income can be used to back loans, ensuring that lenders have a reliable source of repayment.

Benefits of Casino-Backed Lending Protocols

There are several benefits associated with lending protocols backed by casinos:

- Increased Liquidity: These platforms can provide borrowers with faster access to funds, as the casino’s cash flow can help secure loans more efficiently.

- Attractive Interest Rates: With a sustainable revenue model, casino-backed loans may offer lower interest rates compared to traditional lending platforms.

- Engagement with the Gaming Community: This model can attract gamers who are interested in earning interest on their assets while enjoying the thrill of the casino environment.

- Potential for Gamification: By integrating gaming dynamics into the lending process, users may find the experience more engaging and entertaining.

Challenges in the Casino-Backed Lending Landscape

While there are numerous benefits, entering the realm of casino-backed lending protocols is not without challenges:

Regulatory Concerns

The blending of gambling and finance raises red flags in terms of regulatory compliance. Different jurisdictions have varying laws governing both casinos and financial services, which can complicate matters for developers and users alike. Navigating these regulations is essential for the success and longevity of these protocols.

Market Volatility

The cryptocurrency market is notoriously volatile, and combining this with the inherent risks of gambling can create a precarious situation. Borrowers and lenders must navigate sentiment shifts and market conditions that could impact the value of their assets or the casino’s income stream.

Trust and Transparency

Building a reliable platform requires trust from users. The integration of casino operations can bring skepticism, as players may worry about the fairness of the gaming aspect and its impact on lending reliability. Ensuring transparency in operations and gains is fundamental to establishing credibility.

Future of Casino-Backed Lending Protocols

The future of lending protocols backed by casinos appears promising as they tap into a previously unexplored avenue of financial services. By creating strategic partnerships with reputable casinos, developers can harness a steady revenue stream that supports lending activities.

Moreover, as blockchain technology continues to mature, these lending platforms are likely to become more sophisticated, offering better user experiences and more features that seamlessly integrate gaming with borrowing. Innovations such as automated market makers, liquidity pools, and yield farming can potentially enhance the profitability of both sides in a borrowing agreement.

Conclusion

In conclusion, lending protocols backed by casinos present a unique financial solution at the intersection of two dynamic industries. By leveraging casino revenues, these platforms can provide increased liquidity, attractive interest rates, and engaging experiences for users. However, as with any emerging technology, they come with their own set of challenges. Stakeholders need to address regulatory, market, and trust issues to fully realize the potential of this innovative model. As the landscape continues to evolve, we can expect to see more developments and adaptations in how lending protocols operate, making it an exciting area to watch for both investors and gamers alike.